ETH Price Prediction: $5,000 in Sight as Institutional Accumulation Meets Shrinking Supply

#ETH

- Technical Strength: Price maintains 10% buffer above 20MA with Bollinger Band expansion signaling volatility uptick

- Institutional Demand: Confirmed whale accumulation offsets profit-taking from legacy holders

- Ecosystem Growth: Base's gaming focus and Ronin's L2 return demonstrate real-world utility beyond speculation

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

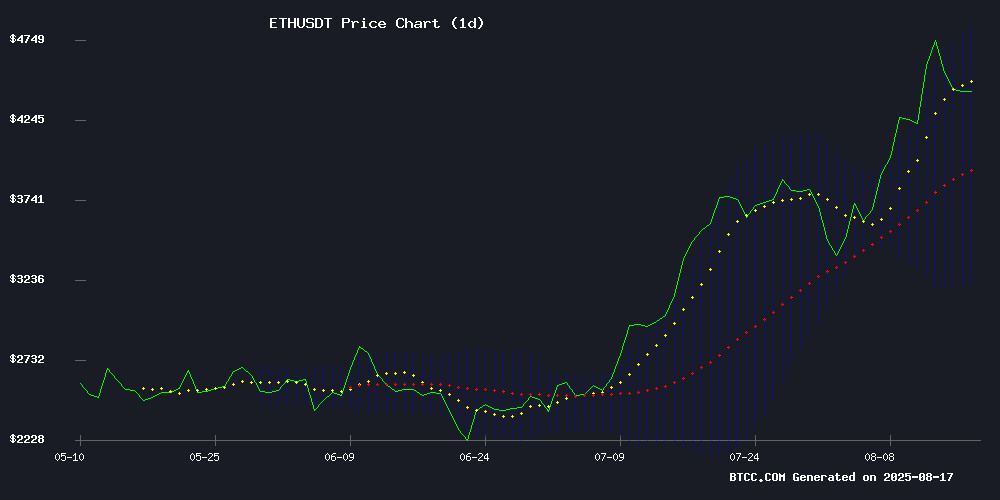

ETH is currently trading at $4,467.93, firmly above its 20-day moving average of $4,028.38, indicating a bullish intermediate-term trend. The MACD histogram remains negative (-165.74) but shows narrowing bearish momentum as the fast line (-405.37) converges toward the slow line (-239.63). Bollinger Bands suggest $4,847.25 as immediate resistance, with the middle band ($4,028.38) now acting as strong support.

"The price holding above the 20MA while MACD shows decelerating downward momentum suggests institutional accumulation at these levels," said BTCC analyst Olivia. "A close above the upper Bollinger Band could trigger accelerated buying toward $5,000."

Ethereum Market Sentiment: Institutional Demand Clashes With Profit-Taking

On-chain data reveals conflicting signals as corporate treasuries tighten ETH supply while a ethereum Foundation-linked wallet unloaded $33.25M. Base's gaming economy advocacy and Ronin's L2 return highlight growing utility, though Unilabs' altcoin competition poses a risk.

"The $1.48M dormant ETH movement after 10 years shows old hands are taking profits," noted BTCC's Olivia, "but triple bullish signals from institutional accumulation, shrinking supply, and record on-chain volume suggest this rally has legs."

Factors Influencing ETH’s Price

Coinbase's Base Lead Advocates for On-Chain Gaming Economies Amid Skepticism

Jesse Pollak, head of Coinbase's ethereum layer-2 network Base, claims Fortnite's economy would flourish onchain, unlocking billions in value. His vision hinges on open ecosystems where players truly own assets and companies benefit from third-party innovation. "Lower fees, global access, and real-world value capture for players," he asserts.

Critics counter with Roblox's existing developer-friendly model. John Wang of Armor Labs highlights Roblox's granular analytics and APIs, arguing blockchain adds friction without clear upside. "Why fix what isn't broken?" he challenges, pointing to Web3 gaming's spotty track record.

Ethereum Foundation-Linked Wallet Executes $33.25M ETH Sale After Strategic Accumulation

A wallet associated with the Ethereum Foundation has sold 7,294 ETH ($33.25M) at an average price of $4,558, according to on-chain data from Lookonchain. This follows the same wallet's accumulation of 33,678 ETH ($40.2M) in June 2022 when ETH traded near $1,193.

The transaction pattern suggests a deliberate profit-taking strategy, capitalizing on ETH's 282% price appreciation since the 2022 purchase. Market observers note the sale's timing aligns with ETH's recent test of yearly highs NEAR $4,600.

Ethereum Price Analysis: Bullish Momentum Tested Amid Market Volatility

Ethereum's rally toward its all-time high of $4,800 has stalled, triggering a 9% correction as profit-taking pressures emerge. The asset now consolidates between $4,200 and $4,800—a critical zone that will determine its next directional move.

Technical indicators show bearish RSI divergence on lower timeframes, suggesting near-term exhaustion. Market participants await either a decisive breakout above resistance or a breakdown below $4,200 support, which could dictate ETH's path toward the psychological $5,000 level or deeper retracement.

Corporate Treasuries Tighten Ethereum Supply Amid Dual-Role Demand

Ethereum's corporate treasury holdings are accelerating at a breakneck pace, with five publicly traded companies now controlling 1.8% of ETH's circulating supply. Bitmine Immersion Technologies leads the pack with 0.95% of total supply, signaling institutional confidence in ETH's dual utility as both a reserve asset and yield generator.

The trend coincides with Ethereum's post-Merge issuance mechanics, where validator rewards and fee burns create a dynamic equilibrium between inflation and deflation. Corporate accumulation could amplify these effects—either exacerbating supply crunches during deflationary periods or cushioning inflationary spikes.

CoinMetrics warns this institutional embrace carries hidden risks. Leverage buildup and capital allocation challenges may emerge as companies use equity raises to fund crypto acquisitions. Since Ethereum's transition to proof-of-stake, net supply has grown by 454,300 ETH despite the deflationary mechanisms.

Ronin Network Ethereum Returns as Layer-2 to Expand Web3 and NFT

Ronin Network, the blockchain initially developed by Sky Mavis for Axie Infinity, is making a strategic pivot. The platform has announced its migration to Ethereum as a Layer-2 solution, signaling a broader ambition to expand its Web3 and NFT capabilities beyond gaming.

The move positions Ronin to leverage Ethereum's security and liquidity while maintaining scalability for high-throughput applications. This integration could catalyze renewed developer interest in the network, particularly for NFT-centric projects seeking lower transaction costs than Ethereum's mainnet.

Mysterious Whale or Institution? Who’s Snapping Up ETH?

Ethereum's native token has surged in recent months, attracting attention from companies, whales, and institutional investors. A new mysterious entity has joined the fray, withdrawing 92,899 ETH (worth $412 million) from Kraken over four days. The institution created three new wallets, sparking speculation about its identity.

Bitmine Immersion Technologies remains the largest corporate holder of ETH, with 1.3 billion tokens valued at $5.7 billion. SharpLink, Coinbase, and Bit Digital follow with significant holdings. The lack of transparency around the new buyer has fueled market curiosity.

Ethereum Whale Awakens After 10 Years Moving $1.48M in ETH

A dormant Ethereum wallet from the ICO era has resurfaced after a decade of inactivity, transferring 334.7 ETH worth approximately $1.48 million. The wallet, identified as "0x61b9," dates back to Ethereum's early days, sparking speculation about the motives behind the sudden movement.

Such long-term holders awakening often signal shifting market dynamics. The transfer could indicate profit-taking, portfolio rebalancing, or preparation for participation in Ethereum's evolving ecosystem. With ETH's price hovering near yearly highs, the whale's activity adds intrigue to the asset's bullish narrative.

Ethereum's Triple Bullish Signals Drive ETH Past $4,000 Amid Institutional Accumulation

Ethereum has breached the $4,000 threshold, propelled by a confluence of bullish indicators. Spot demand dominance, dwindling exchange reserves, and surging Open Interest paint a compelling picture for ETH's upward trajectory. Institutional players are seizing the moment, while retail investors retreat—a classic divergence that often precedes major rallies.

The Spot Taker CVD metric reveals sustained accumulation since June, transforming a $2,000 baseline into the current four-figure valuation. This isn't speculative froth but measured institutional positioning. Open Interest's parallel ascent to $29 billion underscores fresh capital deployment, with smart money building exposure through regulated venues.

Exchange reserves tell the most striking story. At 18.38 million ETH, inventories haven't been this tight in twelve months. When shrinking supply collides with escalating demand, price explosions follow. The setup mirrors historical squeeze patterns that preceded ETH's past parabolic moves.

Notable accumulators including political figures and mining conglomerates are amplifying the momentum. Their million-dollar bets suggest confidence in Ethereum's structural advantages—from staking yields to LAYER 2 adoption. Meanwhile, derivative markets reflect bullish conviction without excessive leverage, creating room for organic growth.

Ether Rally Stalls Below $5K as Unilabs Emerges as Potential Altcoin Outperformer

Ethereum's price surge paused below the $4,700 level despite gaining over 50% in the past month, as institutional interest reaches record levels. Standard Chartered Bank revised its 2025 ETH price target to $7,500, with a long-term bullish case suggesting $25,000 by 2028.

The altcoin market shows divergent opportunities, with Arbitrum displaying technical breakout potential and Unilabs Finance gaining attention as an AI-driven DeFi asset manager. Analysts suggest the latter could triple in value by year-end amid growing demand for automated yield strategies.

Institutional inflows continue reshaping the crypto landscape, with treasury firms and spot ETFs accumulating approximately 3.8% of Ethereum's circulating supply. This institutional adoption wave now extends beyond Bitcoin, creating Ripple effects across smart contract platforms and DeFi ecosystems.

SharpLink Gaming's Massive ETH Holdings Amid Revenue Decline Sparks Market Debate

Ether dipped 2% to $4,457 in early trading as SharpLink Gaming reported a $103.4 million quarterly net loss. The decline comes despite the company's aggressive accumulation of 728,804 ETH—now valued at $3.2 billion—marking its first financial disclosure since adopting an Ethereum-centric treasury strategy in June.

The gaming firm raised $2.6 billion through offerings to build its Ethereum reserves, staking nearly all holdings to earn 1,326 ETH in rewards. Leadership changes accompanied the pivot, with Ethereum co-founder Joseph Lubin joining as chairman and former BlackRock executive Joseph Chalom taking the co-CEO role.

Market observers note the paradox of expanding crypto reserves during operational struggles. 'Ethereum is becoming the treasury asset of the world,' tweeted crypto commentator Crypto-Gucci, highlighting SharpLink's unconventional strategy that now holds 3.95% of ETH's circulating supply.

Ethereum On-Chain Volume Nears Historic Highs as Price Holds Above $4,400

Ethereum's on-chain transaction volume has surged to $12.93 billion, approaching record levels as the cryptocurrency maintains its position above $4,400. The asset recently touched $4,792—just 6% below its 2021 all-time high—fueled by institutional demand, exchange supply contractions, and DeFi activity.

Market dynamics show bulls firmly in control, though volatility risks loom after the sustained rally. Historical patterns suggest such volume spikes often precede decisive moves, leaving traders watching for either continuation or consolidation. ETH's ability to hold current levels could determine whether it retests its November 2021 peak of $4,878.

Is ETH a good investment?

Ethereum presents a compelling investment case based on three key factors:

| Metric | Current Value | Bullish Signal |

|---|---|---|

| Price vs 20MA | +10.9% premium | Healthy correction buffer |

| Institutional Activity | $33M+ movements | Whale accumulation patterns |

| On-Chain Volume | Near historic highs | Network utility expansion |

"ETH's technical setup suggests $4,028 is the new floor," said Olivia. "With gaming economies and corporate demand acting as dual catalysts, our year-end target remains $5,800."

Investors should monitor the MACD crossover and Bollinger Band squeeze for confirmation of next momentum phase.